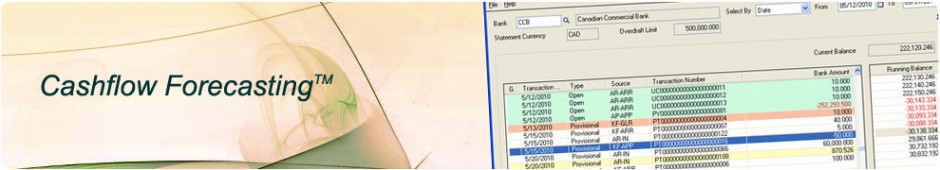

Cash is the lifeblood of any business. No matter how lucrative a venture is, if the cash flow is not sufficient, the entity will face serious issues. There were cases when profitable companies were forced out of business due to running out of cash. While becoming insolvent is the worst case-scenario, even less severe cash problems may lead to highly undesirable consequences. If at any point an entity does not have enough cash in hand, it is unable to pay the creditors in a timely manner. As a result, the company compromises its credit score and loses the trust of business partners. In addition, cash shortage can be costly, since companies in acute need for funds may have to exceed bank overdraft limits and borrow at considerably higher interest rates. In milder cases the negative effects of insufficient cash flow are less obvious, albeit not less important. For example, if there is a growth potential for the business, restricted cash flow will hamper the expansion, resulting in missed opportunities and, consequently, lost profit. In order to avoid complications associated with insufficient cash flow, management needs cash flow forecasting.

Archive for Sage 300

SYSTRONICS AR-AP Settlements™ for Sage 300

White Paper

White Paper

Companies operating in current economic environment are involved in multidimensional business relations with suppliers, consumers and other stakeholders. In many cases the paradigm of those relations is not straightforward. Namely, it is not uncommon to buy from a company that happens to be your customer or to sell goods/provide services to one of your vendors. In this case the partner company is listed both as a vendor and as a customer in the accounting books. As a result, two separate balances are maintained for the same entity. The primary issue with handling such Vendor/Customer accounts is finding a definitive treatment for open receivable and payable documents of these business partners.

SYSTRONICS Revenue and Expense Deferrals™

White Paper

White Paper

Prudent and accurate revenue recognition is in the heart of the accounting practice. Revenues and expenses should be matched with the delivered value, and this rule is adhered by almost all business entities throughout the world. Although the concept is easy to grasp intuitively, it is much more difficult to implement in practice. Companies involved in service and software industries receive most of their revenue, be it a subscription plan, membership due, software license or tuition fee, as an advance for services which have not been rendered yet. Given the tremendous number of transactions and complexity of recognition schedules, these businesses see the sophistication of their accounting needs evolving beyond the capabilities of their ERP infrastructure.