Cash is the lifeblood of any business. No matter how lucrative a venture is, if the cash flow is not sufficient, the entity will face serious issues. There were cases when profitable companies were forced out of business due to running out of cash. While becoming insolvent is the worst case-scenario, even less severe cash problems may lead to highly undesirable consequences. If at any point an entity does not have enough cash in hand, it is unable to pay the creditors in a timely manner. As a result, the company compromises its credit score and loses the trust of business partners. In addition, cash shortage can be costly, since companies in acute need for funds may have to exceed bank overdraft limits and borrow at considerably higher interest rates. In milder cases the negative effects of insufficient cash flow are less obvious, albeit not less important. For example, if there is a growth potential for the business, restricted cash flow will hamper the expansion, resulting in missed opportunities and, consequently, lost profit. In order to avoid complications associated with insufficient cash flow, management needs cash flow forecasting.

Cash flow forecasting is a vital tool for decisions-making in business. It allows to foresee future cash problems and take measures to mitigate their effects. What’s more, with cash flow projections managers can make more informed decisions about new investments. Unfortunately, it is very hard to give a relatively reliable estimate about the inflow and outflow of funds. A lot of factors, like the state of economy, customers’ demand and credit worthiness have to be taken into account. It is virtually impossible to collect all the required data for making a perfectly accurate forecast. That is why many companies prefer to be conservative in their estimates and make sure they will not face unpleasant surprises. While this approach is certainly the safest, it is not very helpful for the management when they make plans for more optimistic course of events.

Another approach is to make more than one cash flow forecast and consider different scenarios. Multiple projections facilitate the planning process and allow to be prepared for future developments. The shortcoming of this method is that in the absence of a proper forecast generating tool it can become an everlasting, tiresome task of creating large spreadsheets that are hard to work with.

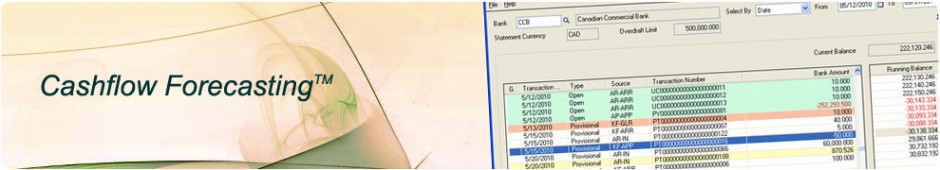

Cashflow Forecasting™ for Sage 300 is a SYSTRONICS product that offers a complete solution for easy and effective cash flow forecasting. With this tool running simulations and conducting “what if” analysis is fast and effortless. It allows to create provisional, i.e., non-permanent, transactions such as receipts, payments, and bank transfers and calculate bank balances forecasts, based on these transactions as of any future date. This way you can see what effect a transaction would have on the bank balance without actually creating that transaction in Sage 300. Provisional transactions can be grouped and you can easily spot all the transactions that belong to the same group. This feature is helpful for evaluating projects you are considering to launch. Cashflow Forecasting is not just a convenient projecting tool. It also simplifies the process of creating transactions in Sage 300. Since the program enables to convert provisional transactions into actual transactions, it is just a matter of seconds to update subledgers and bank account balances. Moreover, with this application you can stop worrying about inadvertently exceeding bank overdraft limits in your forecasts. The transactions that put the bank balance below overdraft limit are highlighted.

In addition to seamless integration with Sage 300, Cashflow Forecasting can be integrated with SYSTRONICS CashWorks™ for Sage 300 to provide comprehensive management for your business.

Cashflow Forecasting is a hands-on tool for creating thorough cash flow projections and scenario analysis that lead to efficient planning and improved business performance.

Leave a Reply