Cash is the lifeblood of any business. No matter how lucrative a venture is, if the cash flow is not sufficient, the entity will face serious issues. There were cases when profitable companies were forced out of business due to running out of cash. While becoming insolvent is the worst case-scenario, even less severe cash problems may lead to highly undesirable consequences. If at any point an entity does not have enough cash in hand, it is unable to pay the creditors in a timely manner. As a result, the company compromises its credit score and loses the trust of business partners. In addition, cash shortage can be costly, since companies in acute need for funds may have to exceed bank overdraft limits and borrow at considerably higher interest rates. In milder cases the negative effects of insufficient cash flow are less obvious, albeit not less important. For example, if there is a growth potential for the business, restricted cash flow will hamper the expansion, resulting in missed opportunities and, consequently, lost profit. In order to avoid complications associated with insufficient cash flow, management needs cash flow forecasting.

-

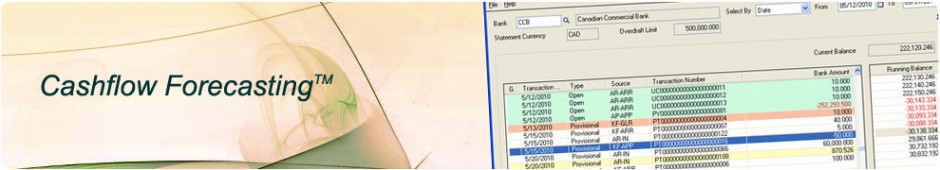

SYSTRONICS Cashflow Forecasting™ Webinar

SYSTRONICS Cashflow Forecasting™: 1. Ready availability of cash flow data. 2. Cash flow optimization through scenario simulations. Tags

Archives

Categories