Companies operating in current economic environment are involved in multidimensional business relations with suppliers, consumers and other stakeholders. In many cases the paradigm of those relations is not straightforward. Namely, it is not uncommon to buy from a company that happens to be your customer or to sell goods/provide services to one of your vendors. In this case the partner company is listed both as a vendor and as a customer in the accounting books. As a result, two separate balances are maintained for the same entity. The primary issue with handling such Vendor/Customer accounts is finding a definitive treatment for open receivable and payable documents of these business partners.

Companies deal with Vendor/Customer accounts differently. Some of them prefer to treat the partner as two separate entities, rather than try to net the overall balance. This approach implies creating receipt and payment transactions for the partner in both receivables and payables ledgers. At first glance this seems to be a safe and failproof option that will not cause any complications. However, this method is counterintuitive and often contradicts widely accepted business practices. In addition to being time-consuming and costly, maintaining documents separately can be an unviable approach when the counterparty wants to settle customer invoices with vendor invoices. Companies that find themselves in this situation have to make an unpleasant choice between refusing to work with partners on that condition and creating instant workarounds that later can prove to be impractical or faulty.

A lot of companies that are striving to be efficient and cost-effective try to find workarounds and apply more feasible accounting treatments. The most commonly used approach involves offsetting vendor balances with customer balances by creating manual adjustments for open documents. While in theory this approach is more reasonable and logical, in practice it is still far from being the optimal solution. Netting the balances and manually creating adjustments for documents in both ledgers can be an extremely tedious and laborious task that requires much time and effort. This downside of the seemingly sensible workaround is especially substantial for larger companies that have more than one Customer/Vendor accounts to handle and have to pay considerable overhead for the additional work.

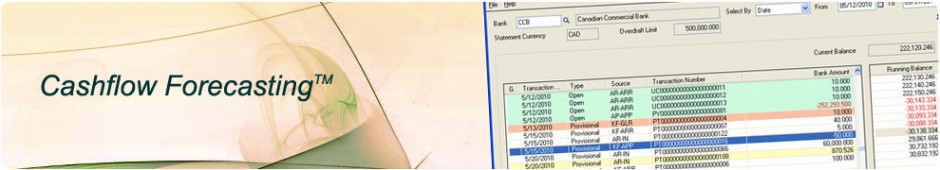

AR-AP Settlements™, developed by SYSTRONICS, provides a simple, yet effective solution for managing open documents in Customer/Vendor accounts. It is a flexible, user-friendly tool that enables settlement of open receivable documents with open payable documents, or vice versa. The program creates adjustments for selected documents and decreases the document balances by the knock-off amount. AR-AP Settlements functionality is not limited to settling open documents of only one entity. You can easily offset documents of multiple Vendors and Customers, as long as they are listed in the same predefined group. Documents of Vendors and Customers with different currencies can also be processed within the same group. Moreover, the offsetting process can be fully automated, thus eliminating the need for manual selection of open documents. As a result, you may pay or receive only the balance amount after the settlement. In addition to easy and efficient document settlements, the application allows to check the outstanding balance of all vendors within a settlement group when entering receipts and the outstanding balance of all customers within a settlement group when making payments. With this handy tool you always have up-to-the-minute information on the amounts that still need to be paid or collected. These beneficial features, combined with AR-AP Settlements core functionality and detailed reporting, ensure easy Vendor/Customer accounts management in your company.

AR-AP Settlements is the ultimate choice for companies that want to have an affordable, convenient and time-efficient Vendor/Customer accounts management tool that works in accordance with their own business needs and preferences.

Leave a Reply